The world of finance is abuzz with the story of Andy Altahawi , a visionary entrepreneur who has launched an exciting journey to list his company on the prestigious Nasdaq and NYSE stock exchanges. Altahawi's brilliant plan involves utilizing the powerful tool of a Reg A+ offering, an avenue for raising capital by selling securities directly to the public. This approach offers significant advantages , allowing Altahawi's company to tap into a broader pool of financers.

The Reg A+ offering is a crucial milestone in Altahawi's grand plan to take his company publicly. It entails a unique challenge for Altahawi and his team, necessitating rigorous preparation and execution.

- Andy Altahwai's company has assembled a dedicated team of experts to navigate the complex process of a Reg A+ offering.

- That team is working tirelessly to ensure compliance with all regulatory requirements and deliver a successful listing on both the Nasdaq and NYSE.

- Individuals interested in being part of this exciting journey can explore Altahawi's company and the Reg A+ offering through authorized websites.

Steering Through Reg A+ Altahawi's Path to Public Markets

Altahawi's trek to becoming a publicly traded company has been marked by strategic decisions . The firm, pursuing public market listing through the Reg A+ structure , has embraced this distinctive route to access capital and amplify its profile.

- Crucial for Altahawi's success has been a thorough comprehension of the Reg A+ regulations . This includes charting the intricate procedures involved in filing, disclosure and investor communication.

- Furthermore, Altahawi has cultivated strong connections with key players within the financial landscape. These connections have been vital in providing guidance and backing throughout their Reg A+ pursuit .

Concurrently, Altahawi's strategic approach to navigating the Reg A+ landscape has set the stage for its triumphant entrance into the public markets. Their story serves as a valuable case study for other companies contemplating a similar path .

Altahawi's Innovative Approach : Leveraging Reg A+ for NASDAQ or NYSE Success?

Can Andy Altahawi, renowned entrepreneur, navigate the intricacies of Reg A+ to achieve his ambitious goals of a listing on either the prestigious NASDAQ or the venerable NYSE? Altahawi's company, Altahawi Enterprises, has been rapidly expanding in recent years. A Reg A+ offering could provide the crucial capital infusion needed to propel Altahawi's ventures onto a global arena. The success of this strategy, however, hinges on several factors.

- Careful market analysis

- A clear roadmap for growth

- Effective investor relations

The path to a NASDAQ or NYSE listing is highly competitive. Only time will tell if Andy Altahawi can successfully leverage Reg A+ to unlock the next chapter in his entrepreneurial saga.

A+ Regulation

Altahawi Group is strategically considering a listing on the prestigious NYSE or NASDAQ stock exchanges. This ambitious goal would provide significant benefits to the company, driving access to a wider pool of investors and strengthening its public profile. Reg A+, a relatively new avenue for companies to raise capital through public offerings, has emerged as a potential tool in Altahawi's arsenal.

By utilizing Reg A+, Altahawi could efficiently generate the necessary funds to fuel here its growth. The legal landscape surrounding Reg A+ offers a streamlined process compared to traditional IPOs, making it an attractive choice for companies like Altahawi that are seeking a rapid path to public markets.

The successful implementation of Reg A+ could pave the way for Altahawi's NYSE or NASDAQ listing, launching it on a trajectory of sustained growth and recognition within the global financial community.

The Company's Pursuit of Nasdaq & NYSE Listing Through Reg A+

Altahawi has embarked on a strategic route to achieve a coveted listing on prominent stock exchanges such as the Nasdaq and NYSE. Employing the innovative framework of Regulation A+, Altahawi strives to raise capital while simultaneously increasing its public profile. Reg A+ provides a unique avenue for companies like Altahawi to tap into the broader capitalist community, driving growth and expansion.{

This move signifies Altahawi's resolve to transparency and accessibility, revealing its confidence in the future. By meeting the stringent requirements of Reg A+, Altahawi seeks to establish itself as a reliable player in the capital markets.

Reg A+: Unlocking the Potential for Altahawi on NASDAQ and NYSE within

Altahawi stands at a pivotal juncture, poised to capitalize significantly on the burgeoning opportunities presented by the capital markets. Through a strategic Reg A+ offering, the company aims to propel its growth trajectory and unlock access to a wider pool of investors. Listing in prestigious exchanges like NASDAQ and NYSE would grant Altahawi unmatched visibility and credibility within the global financial landscape. This strategic move may transform Altahawi into a market leader, fueling its expansion horizons.

By leveraging the thriving ecosystem of these prominent exchanges, Altahawi is poised to attract significant capital investment enabling fuel its research and development efforts, strategic acquisitions, and global reach. Reg A+ offers a streamlined and efficient path for companies like Altahawi to navigate the complexities of public listing, providing them with the platform to achieve their full potential.

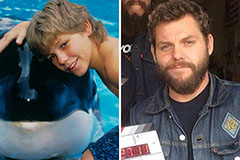

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!